Taxpayers who filed 2018 or 2019 will automatically receive these payments.

File Photo

(Washington, D.C.) – Last week, Washington lawmakers approved a $2 trillion relief bill in response to the coronavirus outbreak.

The Treasury Department and the International Revenue Service announced Monday that distribution of these economic impact payments will begin in the next three weeks and will be automatically distributed with no action required for most people.

One of the main exceptions is some seniors who do not typically file tax returns, if you fall into this category you will need to submit a simple tax return to receive a stimulus payment. This can be found on the IRS website.

The main elements of this package include sending checks directly to individuals and families, money for hard-hit hospitals and health care providers, a major expansion of unemployment benefits, financial assistance for small businesses and $5oo billion in loans for distressed companies.

Taxpayers who filed 2018 or 2019 will automatically receive these payments. Those who filed their taxes individually will be receiving $1,200 and those who filed a joint tax return will be receiving $2,400. Parents of children 16 and under will also be receiving an additional $500 for each qualifying child.

Full payments of the amounts listed above will be given to those with an adjusted gross income of up to $75,000 for individuals and up to $150,000 for spouses. Individuals and spouses whose incomes are about those amounts will have their payments reduced by $5 for every $100 above the thresholds.

It is important to note that individuals or couples who have not submitted a tax filing for 2018 or 2019 can still receive the economic impact payment and are also urged to file as soon as possible so they can receive payment.

Economic impact payments will be made available through the year for those who have not filed a tax return and are concerned about visiting a tax professional in person.

For more information on these payments visit, https://www.irs.gov/coronavirus.

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

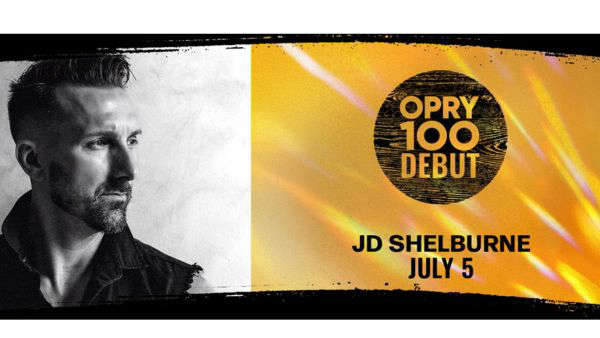

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry