To enforce an unlawful tax mandate

FRANKFORT, Ky. (March 27, 2023) – Attorney General Daniel Cameron and Tennessee Attorney General Jonathan Skrmetti continued their fight today against the Biden Administration’s latest effort to enforce an unlawful tax mandate in the American Rescue Plan Act (ARPA). The attorneys general filed a brief in the U.S. Court of Appeals for the Sixth Circuit asking the full court to deny the Biden Administration’s request to rehear the case.

“In the face of record-high inflation, President Biden continues to fight for control of Kentucky’s taxing authority,” said Attorney General Cameron. “Setting beneficial tax policies for Kentuckians is a decision that belongs to our General Assembly, not the federal government, and we will continue to oppose this mandate, which poses a serious threat to the future economic growth of the Commonwealth.”

The American Rescue Plan Act was passed by the Congress and signed into law on March 11, 2021. Of the nearly $2 trillion included in the Act, approximately $200 billion was to assist state governments with COVID relief. Kentucky received nearly $2.1 billion in COVID-related relief funding. As a condition of receiving the COVID aid, the Act requires states to comply with a tax mandate that effectively prevents states from lowering taxes for its citizens for four years.

In the brief filed today, Attorney General Cameron argues that a U.S. District Court and a panel of the Sixth Circuit have already correctly ruled that the tax mandate is unlawful and wrongly prohibits states that accept COVID-19 relief funding from enacting beneficial tax policies.

In 2021, Attorney General Cameron and Tennessee filed a lawsuit to stop the Biden Administration from enforcing the unlawful mandate in ARPA. A U.S. District Court ruled in favor of Kentucky and Tennessee stating that the federal funds “come with a price—states must forego the exercise of important flexibility and power when it comes to making their own taxing decisions.”

The Biden Administration appealed the decision to the Sixth Circuit, and in late 2022 a Sixth Circuit panel agreed that the tax mandate is unlawful. Now, to overrule the panel’s decision, the Biden Administration has petitioned the full Sixth Circuit to rehear the case.

In a similar case led by West Virginia Attorney General Patrick Morrisey, the U.S. Court of Appeals for the 11th Circuit ruled in favor of a 13-state coalition, determining that ARPA “has affected the States’ sovereign authority to tax by binding them to a deal with ambiguous terms and placing them on the hook for billions of dollars in potential recoupment actions.”

Read a copy of brief here.

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

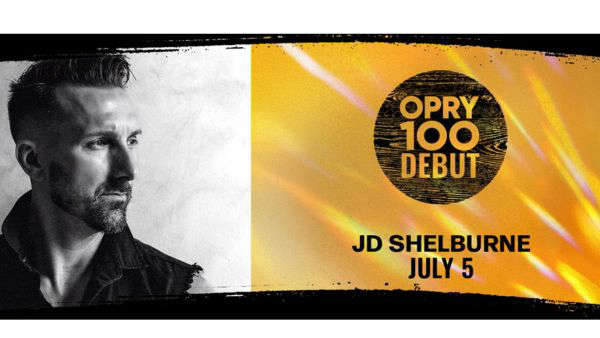

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry