the State collected approximately $21.1 billion in general revenues,

STATEHOUSE -- State of Indiana Comptroller Tera Klutz, CPA confirmed today that the State of Indiana closed the 2023 fiscal year with $2.9 billion in state reserves.

“Indiana’s reserves of $2.9 billion are once again within the healthy range of 10-15% of our fiscal year 2024 budget,” said Comptroller Klutz. “We have prudently managed State resources to ensure appropriate reserves are available to weather any economic shifts that may come."

The State of Indiana began fiscal year 2023 with more than $6 billion in reserve balances. The General Assembly contributed $2.5 billion to the pension stabilization fund and increased the 2023 budget over $3 billion for other one-time expenditures.

“Indiana’s strong fiscal leadership continues to serve all Hoosier residents and businesses well,” Comptroller Klutz continued. “We have just completed another very productive year with taxpayer refunds and historic investments in education, public safety, infrastructure and economic development.”

In addition, the State collected approximately $21.1 billion in general revenues, which was $25 million (0.1%) more than expected and $133 million (0.6%) less than the State collected in 2022.

“Gov. Holcomb and the General Assembly have made substantial investments in critical areas such as public health, education and workforce while paying our long-term obligations,” said Office of Management and Budget Director Cris Johnston. “We continue to maintain a reputation of being a fiscally minded state that meets the needs of all Hoosiers.”

The 2022-2023 Fiscal Year Close-Out Statement, ending on June 30, 2023, is prepared by the State Budget Agency.

“Closing the state fiscal year with a healthy reserve offers financial security if the state faces unexpected economic stress,” said State Budget Agency Director Zac Jackson. “We accomplish this year after year by spending less than the state is projected to take in, even taking into account income tax rate reductions.”

Click here to view the full report.

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

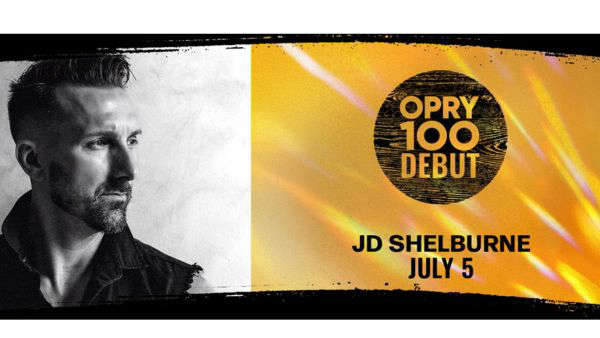

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry