Jefferson, Switzerland and Ripley included in declaration

The U.S. Small Business Administration (SBA) announced today that the SBA has now approved over $1 million in low-interest disaster loans for Indiana businesses and residents affected by the severe storms and flooding from Feb. 14 through March 4, 2018.

“Currently, 36 disaster loans have been approved in the amount of $1,205,000 for affected survivors. SBA representatives are in Indiana to assist survivors with their recovery. SBA disaster loans are an affordable way for businesses and residents to rebuild and resume their normal lives as quickly as possible,” said Richard Morgan, acting director of SBA’s Field Operations Center East in Atlanta.

The disaster declaration covers Carroll, Clark, Elkhart, Floyd, Harrison, Jefferson, Lake, Marshall and St. Joseph counties in Indiana, which are eligible for both Physical and Economic Injury Disaster Loans from the SBA. Small businesses and most private nonprofit organizations in the following adjacent counties are eligible to apply only for SBA Economic Injury Disaster Loans: Cass, Clinton, Crawford, Fulton, Howard, Jasper, Jennings, Kosciusko, La Porte, Lagrange, Newton, Noble, Porter, Pulaski, Ripley, Scott, Starke, Switzerland, Tippecanoe, Washington and White in Indiana; Cook, Kankakee and Will in Illinois; Carroll, Hardin, Jefferson, Meade, Oldham and Trimble in Kentucky; and Berrien, Cass and Saint Joseph in Michigan.

Businesses and nonprofits can apply up to $2 million to repair or replace disaster damaged real estate, machinery, equipment, inventory, and other business assets. Loans for working capital, known as Economic Injury Disaster Loans, are available even if the business did not suffer any physical damage. Homeowners can apply up to $200,000 to repair or replace disaster damaged real estate. Homeowners and renters can apply up to $40,000 to repair or replace damaged personal property including automobiles.

Interest rates are as low as 3.58 percent for businesses, 2.5 percent for private nonprofit organizations, and 1.813 percent for homeowners and renters, with terms up to 30 years. The SBA customizes loan amounts and terms based on each applicant’s circumstances.

Applicants may be eligible for a loan amount increase up to 20 percent of their physical damages, as verified by the SBA for mitigation purposes. Eligible mitigation improvements may include a safe room or storm shelter to help protect property and occupants from future damage caused by a similar disaster.

Applicants may apply online using the Electronic Loan Application (ELA) via the SBA’s secure website at Disasterloan.sba.gov.

To be considered for all forms of disaster assistance, applicants should register online at DisasterAssistance.gov or download the FEMA mobile app. If online or mobile access is unavailable, applicants should call the FEMA toll-free helpline at 800-621-3362. Those who use 711-Relay or Video Relay Services should call 800-621-3362.

The filing deadline to submit applications for physical property damage is July 5, 2018. The deadline for economic injury applications is Feb. 5, 2019.

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

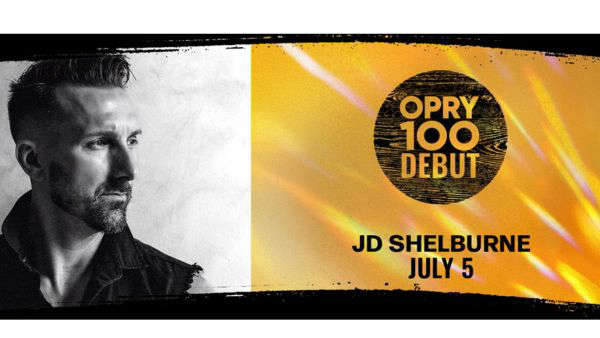

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry