No longer pay state income tax starting with their 2023 tax returns

INDIANAPOLIS – As tax season approaches, Hoosier National Guardsmen, which number approximately 12,000 troops, will no longer pay state income tax starting with their 2023 tax returns.

In April, the Indiana legislature passed the military exemption bill, House Bill 1034, and on May 1, Gov. Eric J. Holcomb signed it into law.

“By completely phasing out state taxes on military veteran retirement in 2022 and eliminating the state income tax for Hoosier Guardsmen in 2023, Indiana continues to demonstrate our state’s enduring appreciation for the exemplary women and men who serve our local communities, state and nation in the Indiana National Guard,” Gov. Holcomb said.

The tax exemption applies to all Hoosier Guardsmen, which includes traditional members, military technicians and full-time National Guard soldiers and airmen.

"I'm grateful for Gov. Holcomb's and the legislature's meaningful support for Hoosier Guardsmen through this exemption from state income tax," said Maj. Gen. Dale Lyles, Indiana's adjutant general. “Soldiers and airmen in our many uniquely rewarding careers will enjoy the additional benefit of keeping more of what they earn while serving our state and nation."

According to the Indiana Department of Revenue, a member of the National Guard is allowed a deduction from adjusted gross income for wages earned as a result of the member’s military service, including service for National Guard state active-duty missions and federalized overseas missions.

The exemption also includes wages earned as a dual-status military technician. A dual-status technician is one who works full-time for the National Guard and must serve in the National Guard for that employment.

Exemptions do not apply for non dual-status technicians or independent military contractors. Exemptions also do not apply for wages earned from employment outside of military service.

Military personnel are required to file an Indiana income tax return if their gross income exceeds their exemptions. Income from all sources, both military and non-military, excluding military combat zone compensation, should be reported on the Indiana resident return, Form IT-40, even if the income is deducted in full for Indiana tax purposes.

More information can be found online at https://www.in.gov/dor/files/reference/ib27.pdf. Learn more about the Indiana National Guard at NationalGuard.IN.gov.

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

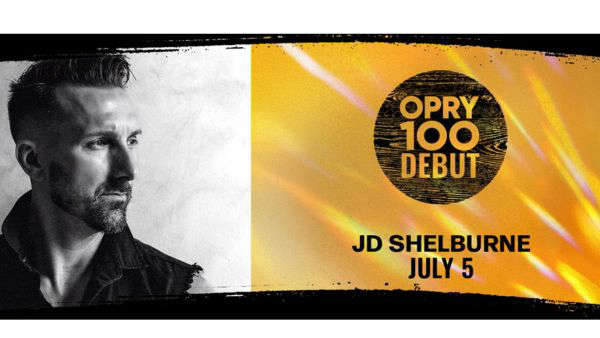

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry