Program enhancements will ensure that support is available

FRANKFORT, Ky. (March 20, 2023) - The Kentucky Historic Rehabilitation Tax Credit is undergoing a major expansion, increasing from the previous allocation of $5 million to a game-changing $100 million. In addition, the Kentucky Legislature has passed a bill raising the maximum eligible credit for commercial projects from $400,000 to $10 million. The provision doubles the current owner-occupied project cap to $120,000 based on Qualified Rehabilitation Expenses (QRE) of $400,000.

These program enhancements will ensure that support is available for continued investment in the commonwealth’s historic structures and cultural resources.

The Kentucky Historic Rehabilitation Tax Credit was established in 2005 as an incentive to encourage the adaptation and reuse of historic buildings. It is often used in tandem with the longstanding Federal Historic Rehabilitation Tax Credit (HTC), a major incentive for commercial and income-producing properties. Both programs are administered in Kentucky by the Kentucky Heritage Council/State Historic Preservation Office (KHC).

“Historic preservation is a huge driver of economic development, and with the annual appropriation increase, the state tax credit program is poised to become even more so,” said Craig Potts, KHC Executive Director and State Historic Preservation Officer. “These credits reward applicants for preserving buildings the right way and for designing projects that respect the historic significance of their properties. It also encourages developers to choose Kentucky over other states for long-term investments.”

Seventy-five percent of the $100 million appropriation will go to income-producing commercial properties and tax-exempt projects, while the remaining 25% will be set aside for owner-occupied residential projects. This ensures funding is specifically available and set aside for homeowners that reside at the property that they are rehabilitating.

For all properties, the applicant that receives the state HTC is responsible for maintaining the property’s rehabilitation and, for three years following the HTC being claimed, must submit any additional proposed alterations to KHC for review. This incentivizes investment and accountability for the properties and projects receiving credits.

Preservation and rehabilitation tax credits continue to be some of the most successful tools to encourage financial investment in historic properties and spark revitalization in communities of all sizes. In addition to leveraging private investment, these programs create jobs, return underutilized properties to service, enhance property values, and often lead to additional investment in surrounding properties.

In 2021 alone, 1,063 projects completed with the federal HTC generated an estimated $7.16 billion in rehabilitation expenditures nationwide. Kentucky ranked 9th nationally among states utilizing the HTC, with 30 successfully completed projects generating $79.6 million of private investment.

For the state credit in 2021, KHC received 113 applications from 20 counties, with 98 of these approved, representing nearly $137 million of proposed private investment in rehabilitation. Since being implemented in 2005, the state tax credit has resulted in 1,166 buildings rehabilitated, with $709 million of private investment in historic buildings leveraged through $51.5 million in credits.

Federal tax credit projects may be submitted any time, while the annual deadline for state tax credit applications is April 29. Per legislation, this gives KHC staff until June 29 each year to review all the projects and send allocation letters to property owners informing them of their portion of the total allocation project pool.

Both programs require a minimum investment of $20,000 over 24 months, or for commercial projects, the adjusted basis, whichever is higher. Both new and existing users of the program are encouraged to visit the KHC website at heritage.ky.gov to learn more about adjusted regulatory and submission procedures for participation.

“We look forward to working with our Certified Local Government communities, Kentucky Main Street programs, local elected officials and other interested citizens to leverage these much-needed improvements to revitalize our older and historic neighborhoods and communities,” said Potts. “The positive impact of historic preservation on economic development statewide will be truly significant, and we are thrilled to usher it in.”

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

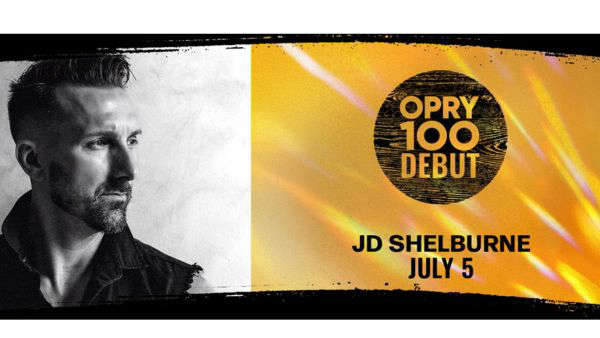

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry