Due May 10th

Property taxes are due Thursday, May 10th. Jefferson Co. residents should start seeing the bills arriving at their home as they were sent out on April 2nd.

Make sure to check your envelope for multiple bills if you own more than one parcel. Make all checks payable to the Jefferson Co. Treasurer.

Payments must be received or federally post-marked by the deadline to avoid penalties. Statement must accompany payment.

Payment Options

- Local Area Banks: German American Bank and Farmers Bank of Milton

- Mail:

- Jefferson County Treasurer

P.O. Box 99

Madison, IN 47250

Statement must accompany your payment

- Jefferson County Treasurer

- Return Paid Receipts: A self-addressed stamp envelope must be included with payment and statement. Send payments to:

- Jefferson County Treasurer

300 E Main, Room 105

Madison, IN 47250

- Jefferson County Treasurer

- In Person: Treasurer’s Office is located at:

- Jefferson County Courthouse

300 E Main Street

Madison, IN 47250

- Jefferson County Courthouse

- Secure After: Hours Drop Box is located at the Courthouse, left side of Main Street entrance, absolutely no cash should be placed in the box.

- Online Payments: A convenience fee will be added by the processor based on the method of payment.

Payments are considered timely if they are received or postmarked on the due date.

USPS Reminds Public Fireworks Don't Belong in the Mail

USPS Reminds Public Fireworks Don't Belong in the Mail

Resurfacing Project on U.S. 42 in Gallatin County

Resurfacing Project on U.S. 42 in Gallatin County

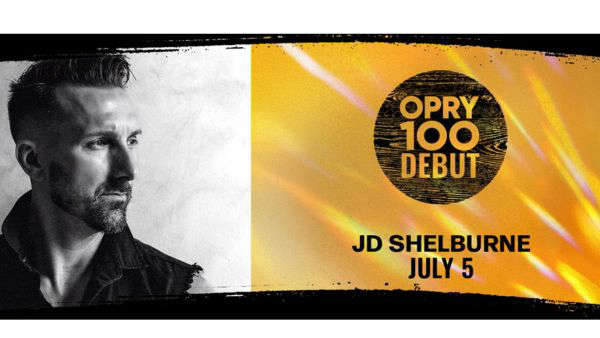

JD Shelburne to Debut at the Grand Ole Opry

JD Shelburne to Debut at the Grand Ole Opry