Fiscal Year ends June 30th

(STORY COURTESY OF KENTUCKY TODAY)

FRANKFORT, Ky. (KT) – The Office of State Budget Director reported Monday that General Fund receipts declined by 7.2% in May 2023 compared to May 2022, but is still on pace to result in a third consecutive year with a budget surplus of over $1 billion.

According to Budget Director John Hicks, total revenue last month was $1.146 billion, marking only the third time that May receipts exceeded $1 billion. Receipts have now grown 3.4% for the first 11 months of FY23, which ends on June 30.

Individual income tax receipts declined by $148 million due to the 10% reduction in the tax rate and a higher amount of tax refunds. Sales and gross receipts rose by 6.2%, or $40 million, and earnings on investments rose by $19.4 million.

Hicks noted, “Year-over-year monthly revenue declines are now to be expected, given the reduction to the individual income tax rate that became effective January 2023. The payroll withholding base continues to rise reflecting higher total Kentucky wages and salaries. The tax rate impact has already been considered in our revenue forecasting. A revenue surplus in excess of $1 billion is still expected, when the annual revenue total is compared to the estimate used in the creation of the current budget.”

Among other General Fund accounts:

--Property tax collections grew 3.7% in May. The public service, as well as omitted and delinquent categories, increased in May while the remaining components all decreased. Still, year-to-date receipts are up 7.3%.

--Cigarette tax receipts fell 10.5% in May and are down 10.1% year-to-date.

--Coal severance tax receipts had their first monthly decline in FY23, falling 3.3%. Collections have increased 41.5% through the first eleven months of the fiscal year.

Meanwhile, Road Fund receipts for May totaled $165.3 million, an 11.2% increase over May 2022 levels. Year-to-date receipts have increased 4.7%. The official Road Fund revenue estimate calls for a 2.7% increase in revenues for the fiscal year, so the Road Fund is now expected to yield a revenue surplus for FY23.

Based on year-to-date tax collections, revenues can drop 16.7% in June and still meet the estimate. Among the accounts, motor fuels revenue rose 9.5% and motor vehicle usage collections grew 10.9%. License and privilege taxes also posted double digit growth (24.2%), bringing growth through the first 11 months up to 3.1%.

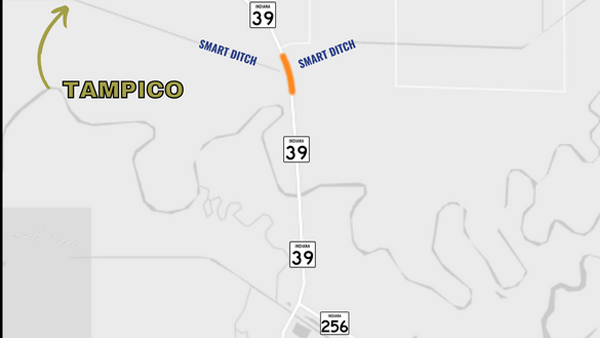

Bridge Work Planned on State Road 39 South of Tampico

Bridge Work Planned on State Road 39 South of Tampico

Indiana State Police Investigating Fatal Shooting in Switzerland Co.

Indiana State Police Investigating Fatal Shooting in Switzerland Co.

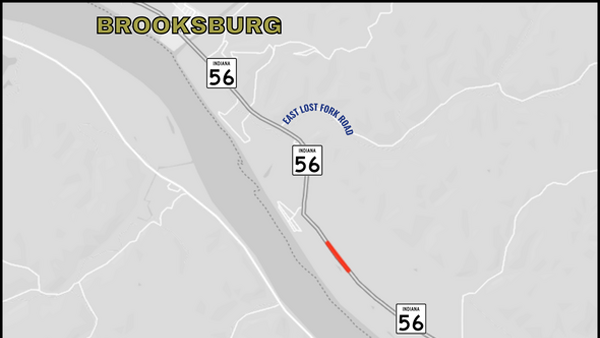

Temporary Closure Planned on State Road 56 in Jefferson County

Temporary Closure Planned on State Road 56 in Jefferson County