Largest budget surplus in history of the commonwealth

(STORY COURTESY OF KENTUCKY TODAY)

FRANKFORT, Ky. (KT) – The Office of State Budget Director reported Monday that General Fund receipts for fiscal year 2023 (which ended June 30) totaled $15.1 billion, exceeding budgeted estimates by $1.4 billion, the largest revenue surplus in history.

Although the final budget surplus amount for fiscal year 2023, FY23, won’t be known until the accounting records for expenditures are completed later this month, this will be the third consecutive year with a General Fund budget surplus of more than $1 billion.

State Budget Director John Hicks said, “The underlying strength of Kentucky’s economy is borne out by this revenue report: more jobs, higher wages and salaries, another year of double-digit growth in sales tax revenues, and continued business profits. The $15.1 billion in revenues also incorporated six months of a 10 percent individual income tax rate cut that went into effect in January 2023. All the major taxes contributed to the $1.4 billion revenue surplus: individual income taxes by $504.3 million, sales and use taxes by $299.4 million, major business taxes by $311.9 million, and property taxes by $99.5 million.”

Sen. Budget Chair Chris McDaniel, R-Ryland Heights, offered the following statement:

"The 2023 revenue report shows the Commonwealth's economy is doing extraordinarily well, which is reflective of Republican leadership over the last eight years. Ultimately, this record surplus — our third consecutive surplus — is validation conservative policies and fiscal responsibility yield optimal results. Amid these record revenue successes and multi-year economic investment victories, the legislature has given the executive branch every financial opportunity to be successful."

The growth rate for FY23 revenues was 3.0%, which follows two years of historically high growth rates. As with June receipts, year-over-year monthly revenue declines are now to be expected given the reduction to the individual income tax rate. An additional tax rate cut, from 4.5% to 4.0% will become effective next fiscal year starting in January 2024.

Meanwhile, Road Fund revenues for FY23 totaled $1.75 billion, an increase of 4.7% from the previous fiscal year, resulting in a $32.3 million revenue surplus above the official revenue forecast, or 1.3%. Total receipts were $78.1 million more than FY22 levels, as all the major accounts had increases. After a slow start to the year, collections accelerated in the last nine months of the year. Growth rates for the four quarters were -0.3%, 7.3%, 5.7%, and 6.1%.

To read the entire report, go to: http://www.osbd.ky.gov.

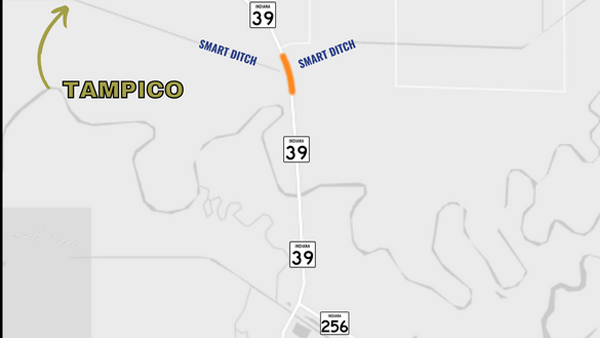

Bridge Work Planned on State Road 39 South of Tampico

Bridge Work Planned on State Road 39 South of Tampico

Indiana State Police Investigating Fatal Shooting in Switzerland Co.

Indiana State Police Investigating Fatal Shooting in Switzerland Co.

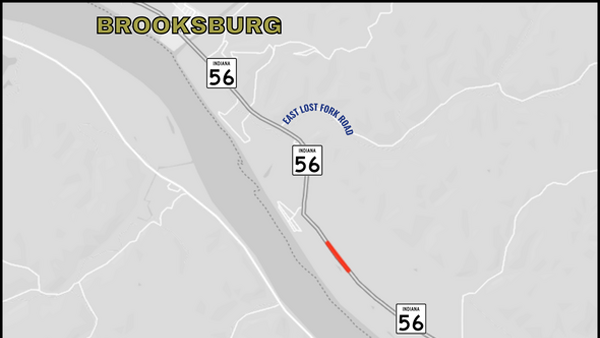

Temporary Closure Planned on State Road 56 in Jefferson County

Temporary Closure Planned on State Road 56 in Jefferson County